Menu

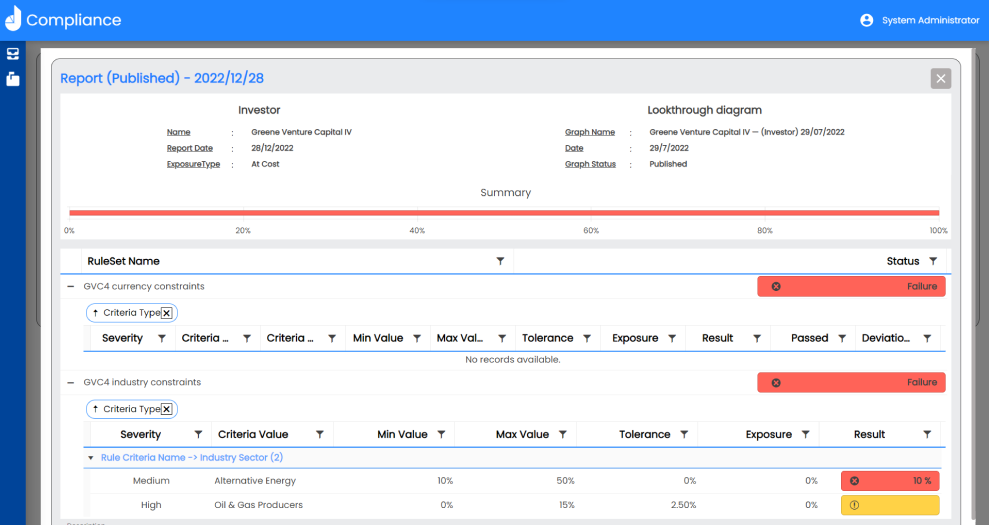

daappa Studio+ Compliance is a powerful, multi-criteria rules-based engine that enables the comparison of portfolio exposures against restrictions and objectives.

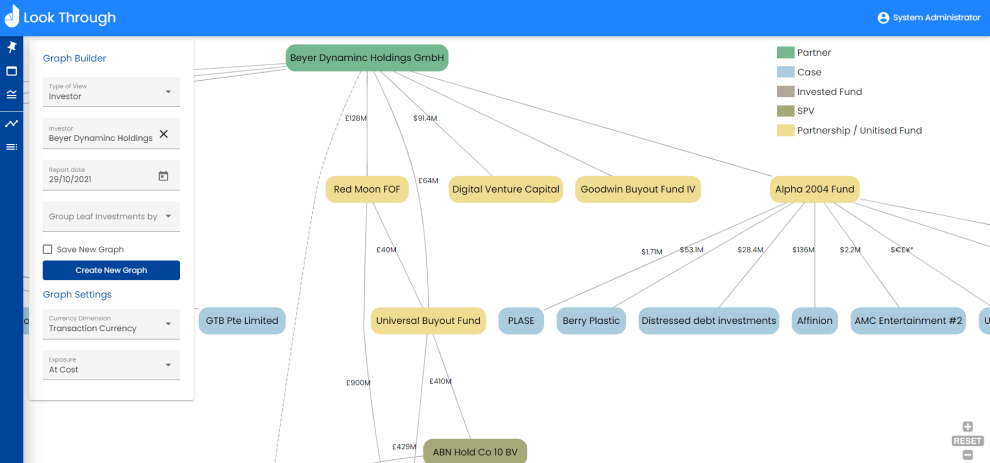

With an intuitive rule builder interface, daappa Studio+ Compliance allows firms to meet investment restrictions, investor compliance and regulatory requirements more effectively than ever before. The compliance engine delivers results through visually rich and customisable dashboards, providing the flexibility to drill down through funds, SPVs and underlying investments.

By assessing ultimate exposures across investors and funds, daappa Studio+ Compliance enables firms to meet ESG requirements, evaluate mandate performance, mitigate funding risk and manage regulatory thresholds.

If you have all the information you need to get going, request a demo and we’ll get back to you straight away.

© daappa Limited 2024. All Rights Reserved.