Menu

daappa Studio is purpose-built to enable seamless integration and to establish a unified and reliable source of truth for users harnessing the capabilities of daappa Core and third-party data sources.

daappa Studio is a powerful and comprehensive data management and functional data warehouse solution crafted to seamlessly integrate daappa Core and/or and your existing front, middle, and back office systems, to provide a unified and efficient experience for your stakeholders.

The daappa DataHub is the foundation of Studio and Studio+ and is designed specifically for private equity and venture capital firms, and it understands the complexities of investments, funds, capital calls, distributions, and valuations.

In the realm of data management, the choice between a Functional Data Warehouse (FDW) and an Enterprise Data Warehouse (EDW) is a pivotal decision for private equity and venture capital firms. While EDWs offer flexible capabilities, daappa’s DataHub provides distinct advantages tailored to the unique needs of the private equity financial industry.

Effortlessly combine data from multiple transaction and accounting sources in one unified platform, built specifically for private equity firms with unique data types and relationships such as investments, funds, capital calls, distributions, and valuations.

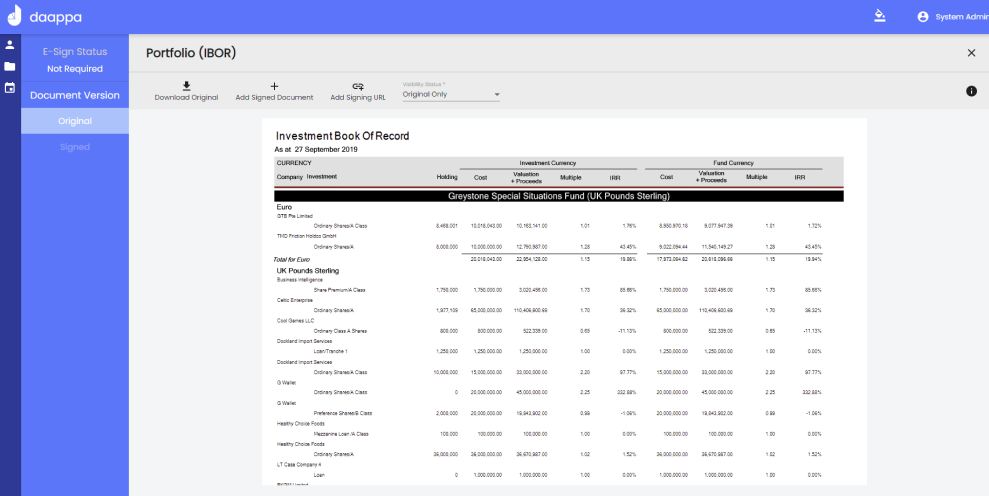

Calculate and track vital private equity KPIs like IRR, TVPI, and DPI, while using Studio+ for the visualisation of tailored datasets, reports, and analytics.

Generate and consolidate your data for investor-specific reports and communications using Studio+, ensuring transparency and compliance with regulatory requirements and industry standards, such as AML, KYC, and GDPR.

Manage funds and investments across various currencies and legal entities with ease, and benefit from periodic snapshots of core client transactional data and real-time integration with external data providers for up-to-date insights.

Smoothly integrate DataHub with other systems via REST API and other file formats, such as CSV and XLSX files received via SFTP, for smooth data flow and interoperability.

Effortlessly combine data from multiple transaction and accounting sources in one unified platform, built specifically for private equity firms with unique data types and relationships such as investments, funds, capital calls, distributions, and valuations.

Calculate and track vital private equity KPIs like IRR, TVPI, and DPI, while using Studio+ for the visualisation of tailored datasets, reports, and analytics.

Generate and consolidate your data for investor-specific reports and communications using Studio+, ensuring transparency and compliance with regulatory requirements and industry standards, such as AML, KYC, and GDPR.

Manage funds and investments across various currencies and legal entities with ease, and benefit from periodic snapshots of core client transactional data and real-time integration with external data providers for up-to-date insights.

Smoothly integrate DataHub with other systems via REST API and other file formats, such as CSV and XLSX files received via SFTP, for smooth data flow and interoperability.

Extractor AI is an innovative solution for GPs and VCs, streamlining data sourcing, management, and aggregation. Leveraging a private-cloud Zanran-driven engine, Extractor can turn structured and unstructured scanned tabular data from PDFs into enriched and context-sensitive data with unparalleled accuracy.

Portal is a bi-directional document-sharing platform that supports the client-stakeholder operations and relationship function. This web-based module provides investors, managers and other stakeholders with investment reports and related documentation.

Portal secures your investor onboarding and report delivery processes in a controlled environment. It can also receive and manage investment company financial data (actuals, budgets and forecasts) through the exchange of Excel or Word templates.

The data-entry templates to capture financial data with Portfolio Monitoring in daappa can be uploaded to the Portal automatically or by daappa users.

Portal also supports E-Signature workflows with HelloSign and DocuSign currently available now and the capability to be integrated with any other e-signature provider

The daappa DataHub Sync enables integrations with other platforms at a level that is common across data and solution providers. Integrations are typically via CSV and XLSX template files sent and received via SFTP, but also include API connections to sync data periodically or by an event.

DataSync enables firms to plug into internal and external systems via REST API including:

A key feature is the execution of customisable data transformation and validation processes, ensuring data precision and uniformity before integration.

For firms who require integrated end-to-end functionality and have retained middle and/or back-office operations, or are performing fund accounting, administration and investor services for others.

For firms who require integrated end-to-end functionality and have retained middle and/or back-office operations, or are performing fund accounting, administration and investor services for others.

As industry practitioners, we understand that you need to do your homework first

© daappa Limited 2024. All Rights Reserved.